International sellers normally have a small disadvantage in terms of their eBay fees. This is not because of any or eBay's policies, but instead because the home countries of those sellers have a VAT tax regime.

How does eBay calculate VAT on final value fees?

The way eBay calculates VAT on final value fees is first by applying the normal 10% rule of all your final sale prices. The VAT is then taken as a percentage of that fee, based on your residence country. Please find the full list of countries and their respective VAT rates below.

The formula for eBay final value fees to include VAT

Let's say you sold some eBay listings for a revenue total of $1000 last month. The first part is easy, eBay will apply their normal 10% rate, and will bill you for $100 ($1000 x 0.10 = $100).

Thankfully, the VAT is only added based on the fee, and not on the whole revenue. If you happen to live in the UK, you know your VAT rate is 20%. And 20% of $100 is $20 ($100 x 0.20 = $20).

Therefore, the total eBay invoice will be for $120 ($100 final value fee + $20 VAT = $120).

The VAT is only a slight increase in your fees

Another way to look at the above UK seller example calculation is like this... the $120 fee of the $1000 revenue is 12%. Compared to the original 10% eBay charges, that's not a big increase at all! It's a disadvantage when competing with domestic sellers on eBay.com, but nothing disastrous.

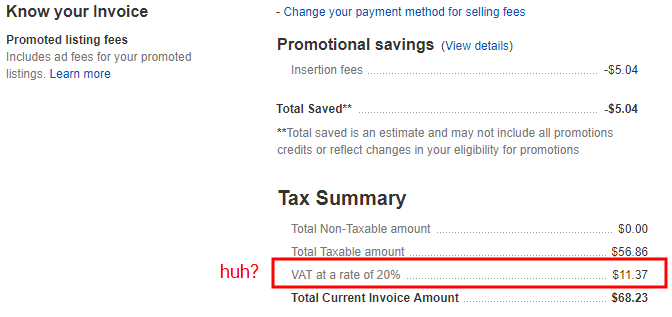

Example eBay fees invoice with the VAT

Above is an example eBay invoice from an international seller. If that seller was living in the US, her total amount would have been only $56.86. However, her home country has a 20% VAT tax rate, and this brings her total eBay fees up to $68.23.

List of countries and their respective VAT tax rates

| Country | Tax Name | Rate |

|---|---|---|

| Afghanistan | VAT rates | 10% |

| Albania | VAT rates | 20% |

| Algeria | VAT rates | 19% |

| Andorra | VAT rates | 4.5% |

| Angola | VAT rates | 10% |

| Anguilla | VAT rates | 0% |

| Argentina | VAT rates | 21% |

| Aruba | VAT rates | 3% |

| Australia | GST rates | 10% |

| Austria | VAT rates | 20% |

| Azerbaijan | VAT rates | 18% |

| Bahamas | VAT rates | 12% |

| Bahrain | VAT rates | 5% |

| Bangladesh | VAT rates | 15% |

| Barbados | VAT rates | 17.5% |

| Belarus | VAT rates | 20% |

| Belgium | VAT rates | 21% |

| Bermuda | VAT rates | 0% |

| Bolivia | VAT rates | 13% |

| Bosnia and Herzegovina | VAT rates | 17% |

| Brazil | VAT rates | 17% |

| Bulgaria | VAT rates | 20% |

| Canada | GST, PST and QST rates | 5-15% depending on Province |

| Cape Verde | VAT rates | 15% |

| Chile | VAT rates | 19% |

| China | VAT rates | 6% |

| Colombia | VAT rates | 19% |

| Cook Islands | VAT rates | 15% |

| Costa Rica | VAT rates | 13% |

| Croatia | VAT rates | 25% |

| Curacao Verde | VAT rates | 5% |

| Cyprus | VAT rates | 19% |

| Czech Republic | VAT rates | 21% |

| Denmark | VAT rates | 25% |

| Djibouti | VAT rates | 10% |

| Dominica | VAT rates | 15% |

| Dominican Republic | VAT rates | 18% |

| Ecuador | VAT rates | 12% |

| Egypt | VAT rates | 14% |

| Estonia | VAT rates | 20% |

| Ethiopia | VAT rates | 15% |

| Fiji | VAT rates | 9% |

| Finland | VAT rates | 24% |

| France | VAT rates | 20% |

| Germany | VAT rates | 19% |

| Ghana | VAT rates | 12% |

| Gibraltar | VAT rates | 0% |

| Greece | VAT rates | 24% |

| Guam | VAT rates | 2% |

| Guinea | VAT rates | 14% |

| Guyana | VAT rates | 18% |

| Honduras | VAT rates | 15% |

| Hungary | VAT rates | 27% |

| Iceland | VAT rates | 24% |

| India | VAT rates | 12% |

| Indonesia | VAT rates | 10% |

| Iran | VAT rates | 8% |

| Ireland | VAT rates | 23% |

| Israel | VAT rates | 17% |

| Italy | VAT rates | 22% |

| Japan | Consumption Sales Tax | 8% |

| Jersey | VAT rates | 5% |

| Jordan | VAT rates | 16% |

| Kazakhstan | VAT rates | 12% |

| Kenya | VAT rates | 16% |

| Kosovo | VAT rates | 18% |

| Kuwait | VAT rates | 0% |

| Kyrgyzstan | VAT rates | 12% |

| Latvia | VAT rates | 21% |

| Lebanon | VAT rates | 11% |

| Liberia | GST rates | 7% |

| Lithuania | VAT rates | 21% |

| Luxembourg | VAT rates | 17% |

| Macedonia | VAT rates | 18% |

| Madagascar | VAT rates | 20% |

| Malawi | VAT rates | 16.5% |

| Malaysia | SST rates | 6% |

| Malta | VAT rates | 18% |

| Mauritius | VAT rates | 15% |

| Mexico | VAT rates | 16% |

| Moldova | VAT rates | 20% |

| Monaco | VAT rates | 20% |

| Montenegro | VAT rates | 21% |

| Morocco | VAT rates | 20% |

| Namibia | VAT rates | 15% |

| Nepal | VAT rates | 15% |

| Netherlands | VAT rates | 21% |

| New Zealand | GST rates | 15% |

| Nigeria | VAT rates | 5% |

| Norway | VAT rates | 25% |

| Oman | VAT rates | 0% |

| Pakistan | Sales Tax rates | 17% |

| Panama | VAT rates | 7% |

| Paraguay | VAT rates | 10% |

| Peru | VAT rates | 18% |

| Philippines | VAT rates | 12% |

| Poland | VAT rates | 23% |

| Portugal | VAT rates | 23% |

| Puerto Rico | VAT rates | 11.5% |

| Qatar | VAT rates | 0% |

| Romania | VAT rates | 19% |

| Russian Federation | VAT rates | 20% |

| Sao Tome and Principe | VAT rates | 0% |

| Saudi Arabia | VAT rates | 5% |

| Serbia | VAT rates | 20% |

| Seychelles | VAT rates | 15% |

| Singapore | GST rates | 7% |

| Slovakia | VAT rates | 20% |

| Slovenia | VAT rates | 22% |

| South Africa | VAT rates | 15% |

| South Korea | VAT rates | 10% |

| South Sudan | VAT rates | 10% |

| Spain | VAT rates | 21% |

| Sri Lanka | VAT rates | 15% |

| St Lucia | VAT rates | 15% |

| Suriname | Sales Tax rates | 10% |

| Sweden | VAT rates | 25% |

| Switzerland | VAT rates | 7.7% |

| Taiwan | VAT rates | 5% |

| Tanzania | VAT rates | 18% |

| Thailand | VAT rates | 7% |

| Togo | VAT rates | 18% |

| Trinidad and Tobago | VAT rates | 12.5% |

| Tunisia | VAT rates | 19% |

| Turkey | VAT rates | 18% |

| Uganda | VAT rates | 18% |

| Ukraine | VAT rates | 20% |

| United Arab Emirates | VAT rates | 5% |

| United Kingdom | VAT rates | 20% |

| Uruguay | VAT rates | 22% |

| Uzbekistan | VAT rates | 20% |

| Vanuatu | VAT rates | 15% |

| Venezuela | VAT rates | 12% |

| Vietnam | VAT rates | 10% |

| Zambia | VAT rates | 16% |

| Zimbabwe | VAT rates | 15% |

Is it possible to avoid paying VAT on eBay fees?

In theory, this is possible, but only for some select countries and depending on your local business registration. You will not be able to stop paying the VAT taxes to eBay, but you may be able to collect those taxes back when you file for taxes. In most cases, this is not worth doing, and will often result in more business costs than what you may ever receive back.

Conclusion

This should give you a good overview of what you will be paying in VAT taxes on your eBay final value fees. It's worth noting that you will not have to do anything because eBay will automatically do the calculations on your behalf. However, when getting into the eBay selling business, and if you're an international seller, then it is worth knowing this in advance and not be surprised later.